As first noted here, I’ve been posting nearly daily on Twitter a bankruptcy case highlight or development that I don’t want to clutter this blog with. RSS Feeds are also available, so you don’t need a Twitter account to access them.

As first noted here, I’ve been posting nearly daily on Twitter a bankruptcy case highlight or development that I don’t want to clutter this blog with. RSS Feeds are also available, so you don’t need a Twitter account to access them.

Here are my posts for the week ended 3/22/2010:

- Valukis report’s glaring omission-E&Y’s fate depends on how NY Ct of Appeals decides questions certified in Refco & AIG-http://bit.ly/buw6Z4

- Oral argument set before Judge Buchwald in GM Tort Claimants’ appeal for 3/24/10, 10:30 am, Rm 21A, SDNY, 500 Pearl St. http://bit.ly/ajh2Mk

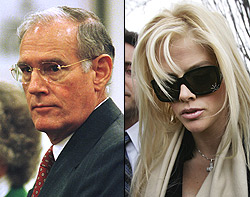

- 9th Cir reverses jdgmt for Anna Nicole, finding that TX probate ct’s earlier findings & legal conclusions were binding. http://bit.ly/bWaMFu

- New blog post on Anna Nicole Smith’s loss on preclusion grounds in fight with Pierce over rights to J. Howard’s money. http://bit.ly/99Ia8Q

- 3d Cir rules 2-1 that Secured Lender has no absolute right to credit bid in a cramdown. Spirited dissent by Ambro, J. http://ow.ly/1pvau

© Steve Jakubowski 2010

6/24/11 Update: Here’s my blog post providing an early analysis of the US Supreme Court’s final 5-4 decision in favor of Pierce’s estate, entitled

6/24/11 Update: Here’s my blog post providing an early analysis of the US Supreme Court’s final 5-4 decision in favor of Pierce’s estate, entitled  As noted in

As noted in  Back in the good old days when bashing BAPCPA was in vogue,

Back in the good old days when bashing BAPCPA was in vogue,  Listening to

Listening to .jpg) [9/3/2010 Update:

[9/3/2010 Update:  Whatever you may think

Whatever you may think [1/13/10 Update: Thanks to Steve Sather from

[1/13/10 Update: Thanks to Steve Sather from  [12/29/09 Update: Be sure to read Tony Prada’s comment at the end of the post. His initial thought, he wrote, was to move on to the next blog but once he started, he "became engulfed with the memoirs" and his "normal 5 minute stop at the blog morphed into 3 hours." Tony shared with us some very important "takeaway" messages that I commend to you.]

[12/29/09 Update: Be sure to read Tony Prada’s comment at the end of the post. His initial thought, he wrote, was to move on to the next blog but once he started, he "became engulfed with the memoirs" and his "normal 5 minute stop at the blog morphed into 3 hours." Tony shared with us some very important "takeaway" messages that I commend to you.] [12/24/09 Update:

[12/24/09 Update: