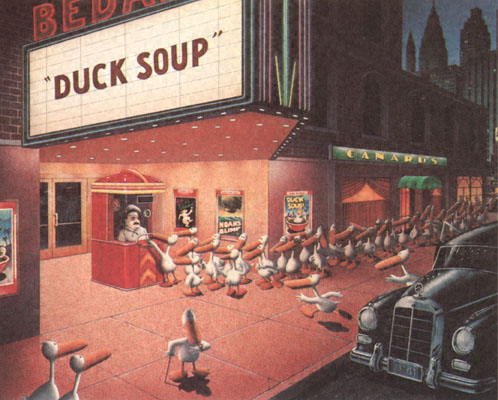

Though its origins are murky, the slang phrase "duck soup" is typically understood to mean "a piece of cake" or "something that is easily done."

Though its origins are murky, the slang phrase "duck soup" is typically understood to mean "a piece of cake" or "something that is easily done."

The Marx Brothers made the phrase famous in their movie Duck Soup, which Roger Ebert calls "probably the best" of the Marx Brothers’ movies (though contemporary audiences apparently didn’t think so).

In hearing of New York Bankruptcy Judge Burton Lifland’s ruling that denied Dana Corp.’s proposed incentive plan for its executives as a disguised retention plan prohibited by BAPCPA’s new Code section 503(c) — and his statement in open court that "this compensation scheme walks like, talks like, and is a KERP" — I was reminded (speaking of "movies with corporate themes") of the opening segment in Duck Soup where Groucho Marx, as the newly inaugurated dictator/president of bankrupt Freedonia (or perhaps, more aptly, "Free-Dan-[i]-a"), outlined his own bonus incentive plan in the movie’s opening sequence:

I will not stand for anything that’s crooked or unfair

I’m strictly on the up and up

So everyone beware

If anyone’s caught taking graft

And I don’t get my share

We stand ’em up against the wall

And pop goes the weasel.

You’ll find some good early commentary on Judge Lifland’s decision here (WSJ Blog), here (CFO.com), here (Boss & Workplace Blog), here (Bankr. & Restr. Blog), here (Credit Slips Blog), and here (Credit Slips Blog). As noted here (in connection with his successful mediation of the dispute in the Enron bankruptcy over Stephen Cooper’s $25 million "success fee" request), Judge Lifland is no stranger to compensation fights. Indeed, his legendary experience on the bench makes his decision all that much more signficant.

Given the ease with which Calpine Corporation’s proposed incentive plan sailed through Judge Lifland’s court only four months earlier, Dana’s advisers (as reported here) "had been confident they would prevail, in large part because … the Dana pay package was modeled on one adopted [in] Calpine." In approving the Calpine plan, Judge Lifland commented from the bench:

Well, based upon this record, and it’s certainly clear to the court that these plans and agreements are proposed in good faith and based upon appropriate business judgment. Further, the record before me validates that the focus of the plans and agreement is to maximize value for all the estates; the plans are apparently designed as incentive plans as opposed to retention or KERP’s.

I do find, based upon this record, that the prohibitions of Section 503 have, if not been avoided, are not applicable based upon the structure of these plans and the agreements. To the one area where there might be potentially an argument to be made that 503(c) would be applicable, that would be in the supplemental plan, but that does not involve insiders, and I think 503(c)(3) is appropriately analyzed to agree with that. In short, I do agree that these are incentive plans to bring enhanced value into the estate. They are not retention plans, although anyone can always make an argument that if people are made happier than they were before, then they are excited enough to stay with the company, but that’s not the focus of these plans. And this would be clearly, based upon this record, not KERP’s and they are not in violation of 503(c). And I will approve the appropriate orders submitted. (See Transcript at pp. 84-85.)

Here’s a copy of the order entered by Judge Lifland in the Calpine bankruptcy case, to which the approved Calpine incentive plan is attached as Exhibit A. For the sake of completeness. Here also you’ll find the Debtor’s motion to approve the incentive plan, the sole objection filed by a small, outgunned Calpine shareholder, and the Debtor’s reply in support. At the near "rubber-stamp" hearing approving the plan, Judge Lifland heard offers of proof from Scott Davido, Calpine’s CFO/CRO, and Nick Bubnovich, a senior consultant from Watson Wyatt (who also provided some benchmarking testimony), as well as statements in support of the incentive plan from Akin Gump’s Mike Stamer on behalf of Calpine’s Official Unsecured Creditors’ Committee.

Approving Dana Corp.’s proposed incentive plan, however, proved to be anything but "duck soup" for veteran bankruptcy lawyer Corinne Ball and her legions at Jones Day in this hotly contested proceeding. Instead, Judge Lifland wrote in striking down Dana’s proposed compensation arrangements, "if it walks like a duck (KERP), and quacks like a duck (KERP), it’s a duck (KERP)." In re Dana Corp., 2006 WL 2563458 (Bankr. S.D.N.Y. 9/5/06) (pdf). He continued:

The Completion Bonus includes an amount payable to the Executives upon the Debtors’ emergence from chapter 11, regardless of the outcome of these cases. Without tying this portion of the bonus to anything other than staying with the company until the Effective Date, this Court cannot categorize a bonus of this size and form as an incentive bonus. Using a familiar fowl analogy [see "duck" quote above], this compensation scheme walks, talks and is a retention bonus. Contrary to the contentions of several objectors, however, the language of section 503(c)(3) does not prevent this Court considering a Compensation Motion using the business judgment rule….

The Debtors have failed here to meet their burden of demonstrating that the payments in exchange for signing a non-compete agreement and other payments do not constitute “severance” for purposes of section 503(c)(2) of the Bankruptcy Code, or that the evidentiary requirements contained in section 503(c)(2) have been satisfied.

In explaining why he approved a comparable plan in Calpine’s bankruptcy case, but would not do the same in Dana’s, Judge Lifland remarked:

The Debtors also compare the compensation programs brought before other courts, in other cases, including the plan brought before this Court in In re Calpine. If this Court is to analyze the Compensation Motion pursuant to section 503(c), the Court must look to the specific circumstances of these cases, and these Debtors. A significant aspect of these cases, in the context of the Compensation Motion, are the issues raised in the strong objections filed by several parties in interest, including the Creditors’ Committee, Equity Committee and United States Trustee and therefore, the Compensation Motion cannot fairly be compared to other compensation motions brought before this Court or other courts. Finding support in this Court’s bench ruling in In re Calpine is misplaced as in that case there was a prima facie case and record to support the application for an "incentive” that was largely unrebutted, therefore not raising the issues currently before this Court.

Or, put another way, "fool me once, shame on you; fool me twice, shame on me."

For those interested, below you’ll find links to all the pleadings (with exhibits) filed by Dana and the objecting parties in connection with the matter. Taken as a whole, they make for some fascinating and enlightening reading:

Dana’s Pleadings

- Dana’s initial motion to enter into employment agreements with its CEO and five key executives (including Terms Sheets (Ex. A – pp. 29-48), Organizational Charts (Exs. B & C – pp. 49-52), Overview of Prepetition Executive Employment Arrangements (Ex. D – pp. 53-57), Comparable Orders from Calpine, Adelphia, WorldCom, and Collins & Aikman bankruptcies (Ex. E – pp. 58-114)).

-

Declaration of John Dempsey of Mercer Human Resource Consulting in support of Dana’s motion (including Peer Group Compensation Analysis (Ex. 1 – pp. 11-12), Compensation Summary for the 6 Executives (Ex. 2 – pp. 13-18), Comparison of Compensation Packages of Chapter 11 CEO’s in Companies with over $3.5 Billion in Sales (Exs. 3 & 4- pp. 19-22), Pre-BAPCPA Compensation Plans (Ex. 5 – pp. 23-27), Post-BAPCPA Compensation Plans (Ex. 5 – pp. 28-33)).

-

Declaration of Richard Priory, Dana’s Comp. Committee Chairman, in support of Dana’s motion (explaining the independent board members’ justification for approving the proposed compensation packages).

-

Dana’s Supplement to the Motion, including "Modified Agreements" to address Creditors’ Committee concerns (also including Modified Term Sheets (Ex. A – pp. 11-49), Calculation of Bonus Triggering "Threshold Total Enterprise Values" and "Target Total Enterprise Values" (Ex. B. – pp. 50-51), Order of Judge Lifland in In re Calpine Approving CEO and CFO/CRO Employment Agreements (Ex. C. – pp. 52-94)).

-

Supplemental Declaration of John Dempsey in support of Dana’s Supplement to the Motion, including the proposed "Modified Agreements" and "Modified Completion Bonus Program" (also including Graphic Summary of Compensation to Chapter 11 CEO’s in Companies with over $3.5 Billion in Sales (Ex. A – pp. 14-15)).

-

Second Supplemental Declaration of John Dempsey (disclosing hourly rate and name of article published in last 10 years).

-

Dana’s Omnibus Reply to all objections to the Motion (including Excerpts from Priory’s Deposition (Exs. A & B – pp. 55-111), Ford 8/18/06 Press Release (Ex. C – pp. 112-115), Dana Press Releases & 8-K (Exs. D & E – pp. 116-137), Transcript of Calpine Hearing Approving Management Incentive Plan (Ex. F – pp. 138-141), Transcript from Nobex Hearing in Delaware Approving Management Incentive Plan (Ex. G – pp. 142-145), Scott Hatton Correspondence re Executive Comp. Discussion Points (Ex. H – pp. 146-148), Transcript from Delphi Hearing in NY on the Role of an Equity Committee (Ex. I – pp. 150-151)).

-

Second Supplement to Dana’s Motion (including further revisions to proposed employment agreements in effort to resolve parties’ objections).

Pleadings of the Objecting Parties

© Steve Jakubowski 2006